Financial Information

Unaudited Financial Statements Announcement For the half year and full year ended 31 December 2025

Financials Archive

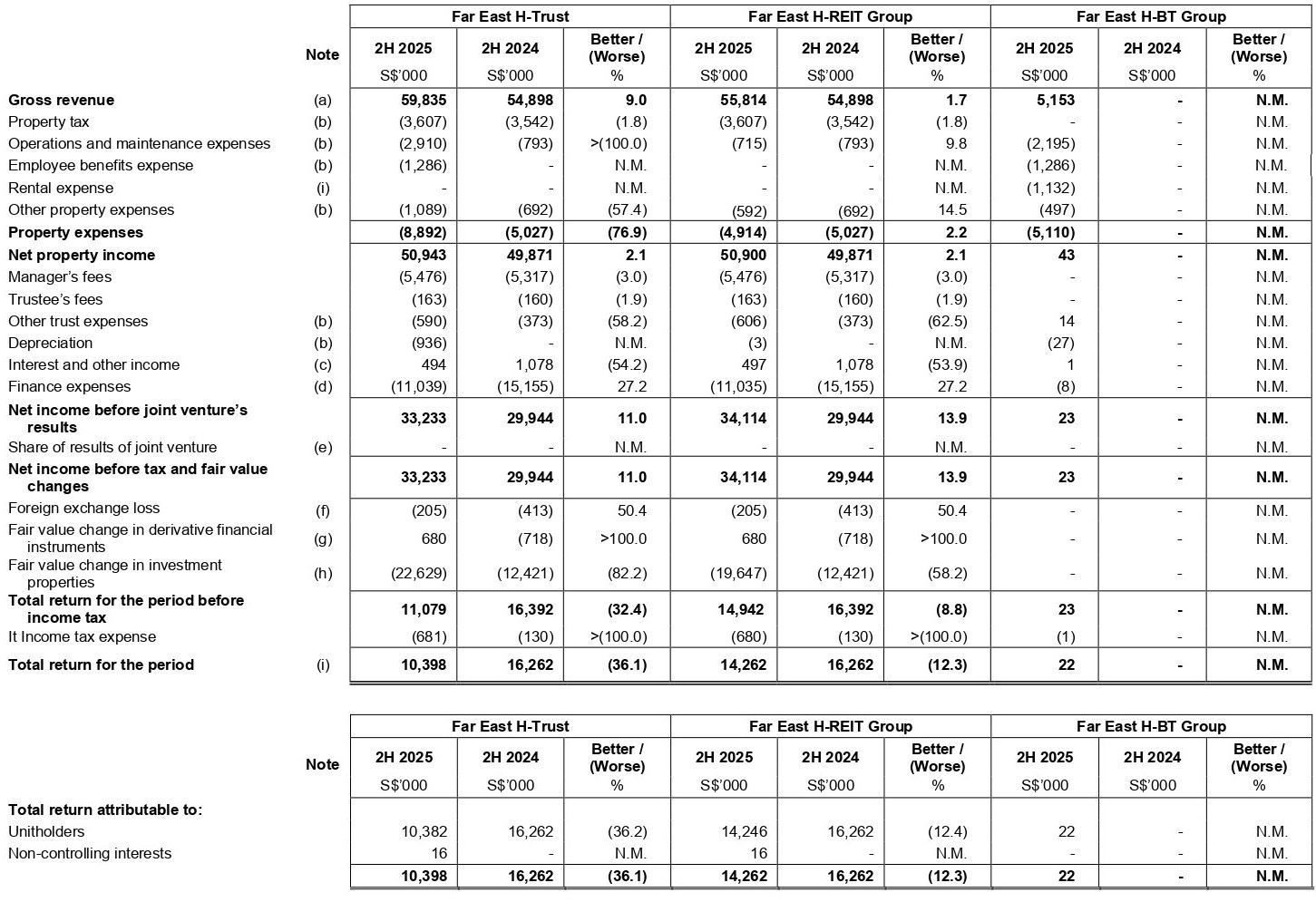

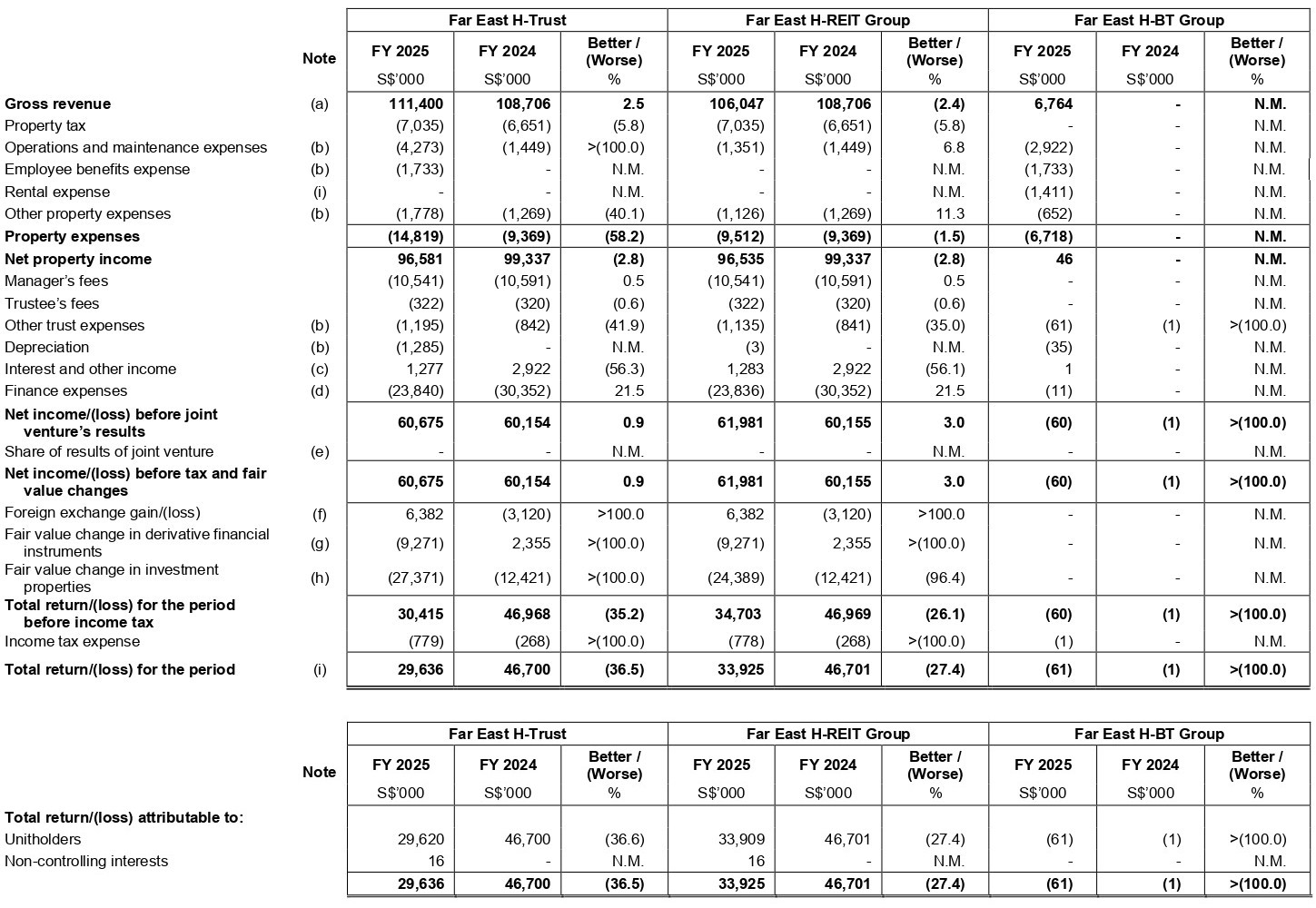

Statements of Total Return, Statements of Other Comprehensive Income and Distribution Statements

Notes:

NM - Not meaningful

- Refer to section 8 on “Review of performance” for the explanation of variances.

- The increase in these expenses is mainly due to the inclusion of hotel operating expenses following the acquisition of FPN which was completed on 25 April 2025. Far East H-Trust’s other property expenses for 2H 2025 and FY2025 include impairment losses on trade receivables of S$55k and S$73k respectively. (2H 2024: S$83k and FY2024: S$123k).

- Lower interest and other income is mainly due to lower interest income from fixed deposits and joint venture.

- Lower finance expenses are mainly due to lower fixed rates on interest rate swaps and lower interest rates on the floating rate loans.

- The share of results of joint venture relates to the equity accounting of Fontaine Investment Pte Ltd (“FIPL”)’s results. The share of losses has exceeded the carrying amount of the investment since December 2021.

- The foreign exchange gain arose mainly from exchange differences on the JPY and US dollar denominated term loans. Cross currency swaps (“CCS”) have been entered into to hedge against any foreign exchange exposure on the US dollar denominated principal and interest payments. This is a non-tax chargeable / deductible item and has no impact on the taxable income and distributable income to the Stapled Securityholders.

- This relates to net change in fair value of interest rate swap and CCS contracts entered to hedge against the interest rate and foreign currency exposure of Far East H-REIT. This is a non-tax chargeable / deductible item and has no impact on the taxable income and distributable income to the Stapled Securityholders.

- The fair value change in investment properties of S$27.4 million for FY 2025 in the Far East H-Trust arose from the revaluation of the Trust’s properties in Singapore as at 31 December 2025. For Far East H-REIT Group, the fair value change in investment properties of S$24.4 million for FY 2025 includes the revaluation gain of the Japan property as investment property which is reclassified to Property, Plant and Equipment in Far East H-Trust. Please refer to Note 1(e)(3) Investment properties for more details. This is a non-tax chargeable / deductible item and has no impact on the taxable income and distributable income to the Stapled Securityholders.

- Far East H-BT Group acts as the master lessee of FPN and the loss is attributable to the master lease rental expense paid to Far East H-REIT Group.

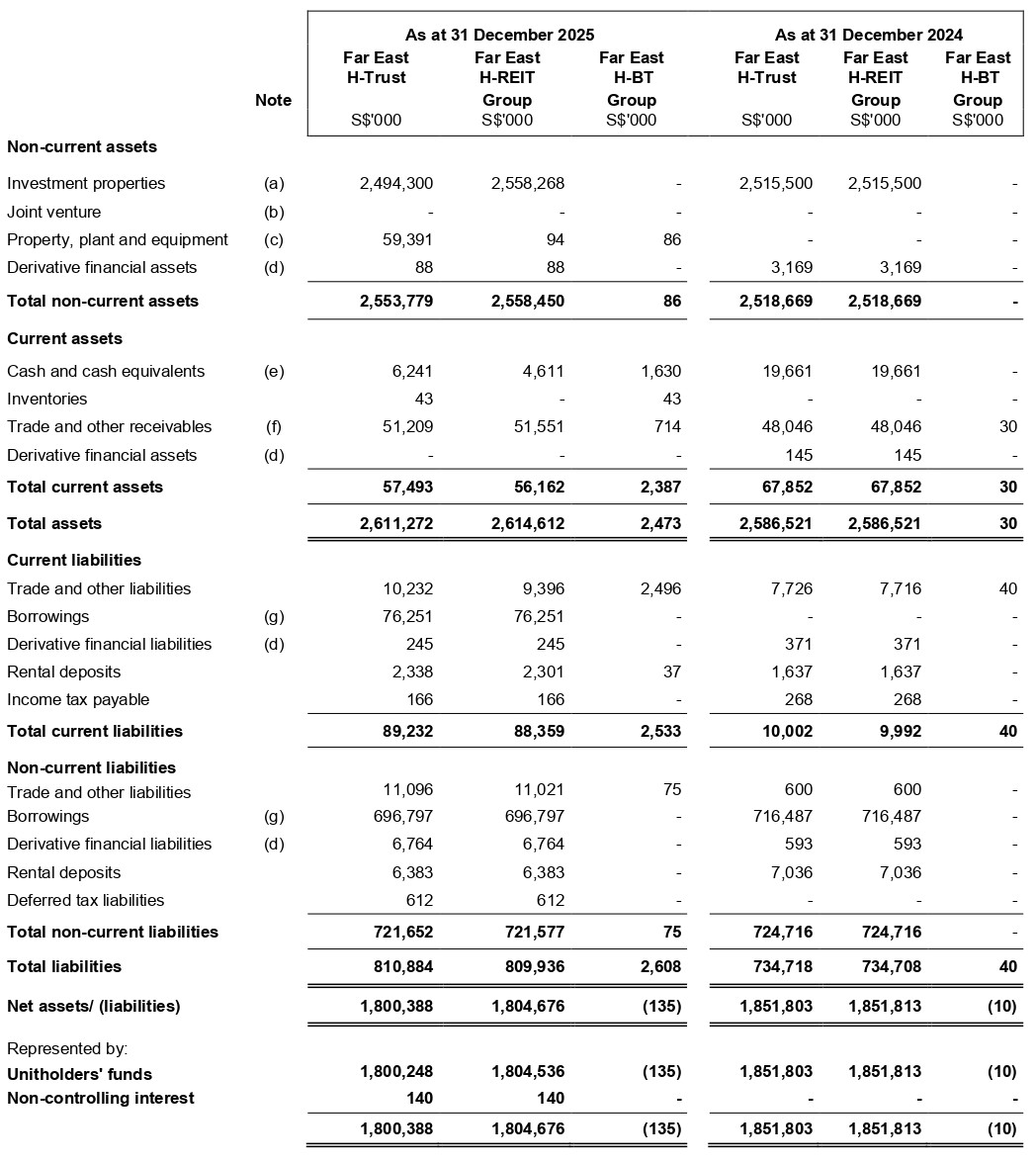

Balance Sheets as at 31 December 2025

Notes:

-

For Far East H-Trust, investment properties pertain to Singapore properties. The decrease in investment properties

at Far East H-Trust was mainly attributable to fair value change in the Singapore investment properties of S$27.4

million partially offset by the capital expenditure capitalised mainly for Village Hotel Changi, Oasia Hotel

Novena,

Village Hotel Bugis and Rendezvous Hotel Singapore.

For Far East H-REIT group, investment properties pertain to both Singapore and Japan properties. The increase in investment properties was primarily due to the acquisition of FPN on 25 April 2025, coupled with the fair value uplift of S$3.0 million for FPN and capital expenditure for the Singapore properties, partially offset by the decrease in fair value of the Singapore properties.

Please refer to the details in Note 1(e)(3) Investment properties. - This relates to the 30% joint venture interest in FIPL, for which the share of losses exceeded the carrying value of investment as at 31 December 2025.

-

The increase in property, plant and equipment as at 31 December 2025 relates to acquisition of FPN and

CENTRAIR hotel systems, Ltd.

Please refer to the details in Note 1(e)(4) Property, plant and equipment. - This relates to the fair value of interest rate swap and CCS contracts entered to hedge against interest rate risk and foreign exchange exposure of Far East H-REIT.

- The decrease in cash and cash equivalents is mainly due to the payment of distributions.

- This includes a shareholders’ loan and accrued interest due from FIPL of S$37.4 million. The amount is used to finance the development of Village Hotel Sentosa, The Outpost Hotel Sentosa and The Barracks Hotel Sentosa which commenced hotel operations in 2019.

-

The total gross borrowings as at 31 December 2025 of S$774.8 million was S$56.7 million higher compared to

balances as at 31 December 2024 due to the drawdown of term loan facilities of JPY5.9 billion, issuance of JPY0.5

billion TMK bonds and revolving credit facility (“RCF”) of JPY387.1 million to fund the acquisition of FPN in

April

2025, and partially offset by unrealised foreign exchange gain on the JPY borrowings and US dollar denominated

term loan.

On 11 December 2025, a new facility of S$101.4 million with an option for either US or Singapore dollar denomination was drawn down to early refinance the existing S$101.4 million term loan ahead of its maturity on 31 March 2026.

The current borrowings relate to term loans of JPY 440.4 million and S$62.5 million term loans due to maturing in October and December 2026 respectively as well as RCF of S$10.2 million which is payable on demand.

The JPY 440.4 million term loan was drawn down to fund the refundable consumption tax for the purchase of FPN and is expected to be repaid upon receipt of the consumption tax refund before October 2026. For the S$62.5 million term loan due to mature in December 2026, Management has commenced discussion with the existing lender to exercise the extension option for the term loan for another 3 years provided in the loan agreement. The refinancing of the term loan is expected to be finalised before its maturity date.

As at 31 December 2025, Far East H-REIT has undrawn and uncommitted RCF of S$264.8 million with 3 banks to fulfill its liabilities as and when they fall due.

Please refer to the details of aggregate amount of borrowings as disclosed in Note 1(e)(5) Borrowings.

Review of the performance of half year ended 31 December 2025

2H 2025 vs 2H 2024

Gross revenue for 2H 2025 increased 9.0% year-on-year (“YoY”) to S$59.8 million, driven primarily by a S$5.2 million contribution from FPN following the acquisition in April 2025, and continued growth in Commercial Premises and Other Income. Together, the higher contributions more than offset the softer master lease rental income from the Singapore Hotels and Serviced Residences, with the YoY decline narrowing from 9.8% in 1H 2025 to 1.8% in 2H 2025.

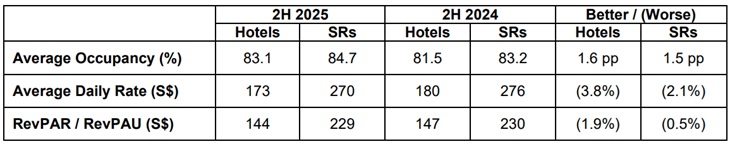

The Singapore Hotels benefited from seasonally stronger travel demand compared with the first half of the year, supported by the summer holiday period and key events. Occupancy rose 1.6 percentage points (“pp”) to 83.1%, while average daily rate (“ADR”) declined to S$173 amidst a competitive pricing environment. As a result, revenue per available room (“RevPAR”) eased 1.9% YoY to S$144, with higher occupancy partially offsetting softer rates.

For the Serviced Residences, revenue per available unit (“RevPAU”) remained broadly stable at S$229 despite softer corporate demand. A shift towards leisure travellers offset the decline in corporate stays and supported occupancy. Performance across the serviced residences was uneven, which limited overall pricing uplift and resulted in softer blended average rates.

A snapshot of the performance of the Hotels and SRs in Singapore for 2H 2025 is set out below.

For FPN in Japan, revenue for the second half of the year amounted to S$5.2 million. Operationally, FPN demonstrated a positive performance3 with RevPAR increasing 7.6% YoY to ¥8,334, supported by Meetings, Incentives, Conventions and Exhibitions (“MICE”)-related demand and improving airport traffic. Gross operating profit rose 10.5% YoY, reflecting continued recovery and disciplined cost management.

Commercial Premises and Other Income increased 6.7% YoY to S$9.3 million, supported by higher occupancies across both retail and office spaces, as well as higher rental rates from the office space. Leasing activity remained healthy, underpinned by sustained tenant demand and steady renewals.

Net property income (“NPI”) rose 2.1% YoY to S$50.9 million, supported by a positive contribution of approximately S$1.1 million from FPN. Excluding FPN, NPI from the Singapore portfolio as a whole remained broadly stable YoY at approximately S$49.8 million, reflecting resilient underlying performance. Overall, FPN was accretive to Far East H-Trust’s NPI, underscoring the benefits of geographic diversification and reducing reliance on a single market.

Income available for distribution increased 13.0% YoY to S$37.0 million4, mainly reflecting lower net finance expenses which declined by S$3.5 million, alongside a higher NPI. However, distribution to Stapled Securityholders decreased 6.3% YoY to S$39.3 million, largely due to a lower distribution of other gains of S$2.5 million compared with the prior year of S$9.9 million. Consequently, distribution per Stapled Security (“DPS”) declined 7.7% YoY to 1.92 cents. Excluding the distribution of other gains, distribution based on taxable income increased by 14.8% YoY to S$36.8 million.

FY 2025 vs FY 2024

Gross revenue for FY 2025 increased 2.5% YoY to S$111.4 million, driven by the maiden contribution of S$6.8 million from FPN, the Far East H-Trust’s first overseas asset, and continued growth in Commercial Premises and Other Income. These more than offset weaker master lease rental income from the Singapore Hotels and Serviced Residences, amidst a competitive operating environment.

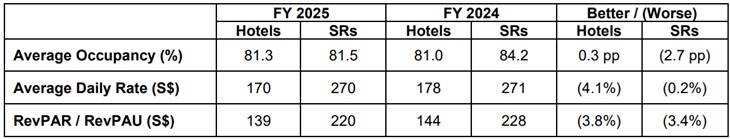

During the year, the Singapore Hotels recorded a 0.3 pp improvement in average occupancy to 81.3%. ADR declined 4.1% to S$170, reflecting a more competitive operating environment and the absence of large-scale events that had supported demand in the prior year, resulting in fewer peak pricing opportunities. Softer corporate and leisure demand in the first half of the year also weighed on room rates. As a result, RevPAR declined 3.8% year-on-year to S$139. Performance improved in the second half of the year, with more stabilised economic conditions, major events such as the World Aquatics Championship, and targeted tactical promotions.

For the Serviced Residences, average occupancy was 81.5%, reflecting softer corporate demand, particularly in the first half of the year. ADR remained stable at S$270, supported by a higher proportion of leisure and short-stay guests, which partially mitigated the impact of weaker long-stay corporate bookings. Consequently, RevPAU declined 3.4% year-on-year to S$220.

A snapshot of the performance of the Hotel and SR segments in Singapore for FY 2025 is set out below.

Commercial premises in the portfolio performed well, with revenue rising 6.5% YoY to S$18.5 million, driven by improved occupancies and higher rental rates, especially for the office units. The commercial premises continued to be resilient and provided stable support to the portfolio. Leasing activity remained healthy, supported by sustained demand and steady tenant renewals.

Income available for distribution increased 1.9% YoY to S$68.0 million, primarily due to lower net financing costs of S$4.9 million, which more than offset the decline in net property income. However, distribution to Stapled Securityholders decreased 7.5% YoY to S$75.3 million, largely due to a lower distribution of other gains of S$7.9 million compared with the prior year of S$16.1 million. Consequently, DPS declined 8.4% YoY to 3.70 cents. Excluding the distribution of other gains, distribution based on taxable income increased by 3.2% YoY to S$67.4 million.

Commentary on the competitive conditions of the industry in which the group operates and any known factors or events that may affect the group in the next reporting period and the next 12 months.

After a slowdown in 2025 caused by macroeconomic uncertainties, the hospitality sector in Singapore is expected to stabilise and benefit from a steady pipeline of major leisure and MICE-related events in the near term. Major MICE events in the first half of 2026 include the biennial Singapore Airshow, the expanded Food & Hotel Asia trade fair, and Herbalife Extravaganza, a large-scale corporate and incentive event. The commencement of Disney Cruise Line’s Disney Adventure homeporting operations in Singapore from March 2026 is also expected to support incremental cruise-related visitation and tourism spending, with positive spill-over effects for the hospitality sector.

In addition, the opening of new attractions, including Minion Land at Universal Studios Singapore, the Singapore Oceanarium and Rainforest Wild Asia, is expected to continue enhancing Singapore’s appeal as a fresh and attractive destination for both repeat and first-time visitors.

Air connectivity to Singapore continues to improve with the addition of new routes and increased flight frequencies across key regional and long-haul markets, enhancing accessibility for both business and leisure travellers.

In Japan, inbound tourism remained robust through 2025, with visitor arrivals continuing to grow beyond pre-pandemic level. In the short term, geopolitical tensions with a key source market may weigh on demand. Despite this, Japan continues to benefit from strong destination fundamentals, supported by its rich cultural offerings, diverse tourism experiences, good pipeline of international MICE events and a relatively weak Yen. All these factors are expected to sustain the country’s attractiveness as an affordable and compelling travel destination.

Against this backdrop, the Managers remain focused on optimising portfolio performance amidst ongoing macroeconomic uncertainty, increased hotel supply and a strong Singapore dollar. Furthermore, the Trust has a diversified range of hotels which cater to a wide range of guests, including those from the price-sensitive mass market segment. With a strong balance sheet and ample debt headroom, Far East H-Trust is well positioned to pursue selective, yield-accretive opportunities while maintaining financial resilience.

Notes:

3 RevPAR and GOP comparisons assume ownership of FPN during the same period in 2H 2024.

4 S$9.5 million of the distribution was paid as an advance distribution on 25 September 2025, relating to

the period from 1 July 2025 to

19 August 2025 before the issuance of the earn-out Stapled Securities for the acquisition of Oasia Hotel Downtown.